Principles-led, strategic financial risk and accounting advisory.

Educating. Policy and process formation. Hedging. Derivative accounting

Signed in as:

filler@godaddy.com

Educating. Policy and process formation. Hedging. Derivative accounting

We are here to provide your company with support around all aspects of financing, financial risk management (e.g. hedging using derivatives) and accounting, including hedge accounting. Whether your concern is around building capability in your team, valuing positions, managing a single cash flow hedge transaction, or developing an entire process around the quantification, management and reporting of financial business risks, debt and derivative portfolios, we can help.

To discuss your needs and concerns please contact Mark at:

Mark.Ogorman@principlesconsult.com

+44 797 005 1261

Or using the WhatsApp or Booking functions below

Before formation of a risk management strategy can even begin we must establish a firm understanding of what your financial business risks look like and where you want to get to in managing them.

This will often require a degree of process mapping, process adjustment and perhaps education on risk factors, risk metrics, risk quantification, derivative accounting/valuation and financial or management reporting. Whether your issue is hedging a single floating rate loan, consolidating foreign currency cashflows from multiple business entities , or assessing and managing risks of an event, we can ensure that risk management actions are understood, in line with best practice and will not give rise to undue complexity or cost for your business.

We are passionate about helping both companies and individuals simplify complexity.

Ensuring that your team has a solid understanding of the fundamentals of risk management and reporting will ensure that your strategy is implemented, as intended, long after we leave. Of course, on-going support is available whenever required.

Building capability and process efficiency within your team will develop the individuals, enhance job satisfaction for them and improve the efficacy of your finance and risk management functions. Ultimately this results in better outcomes for your business.

It also better future-proofs your support functions as the business and financial risk complexity grows.

I qualified as an ACA accountant at KPMG in 2001, auditing some of the largest Banks in the world for the first 6 years of my career. I then became a technical transaction accounting specialist across UK GAAP, IFRS and US GAAP at firms including BNP Paribas and Morgan Stanley.

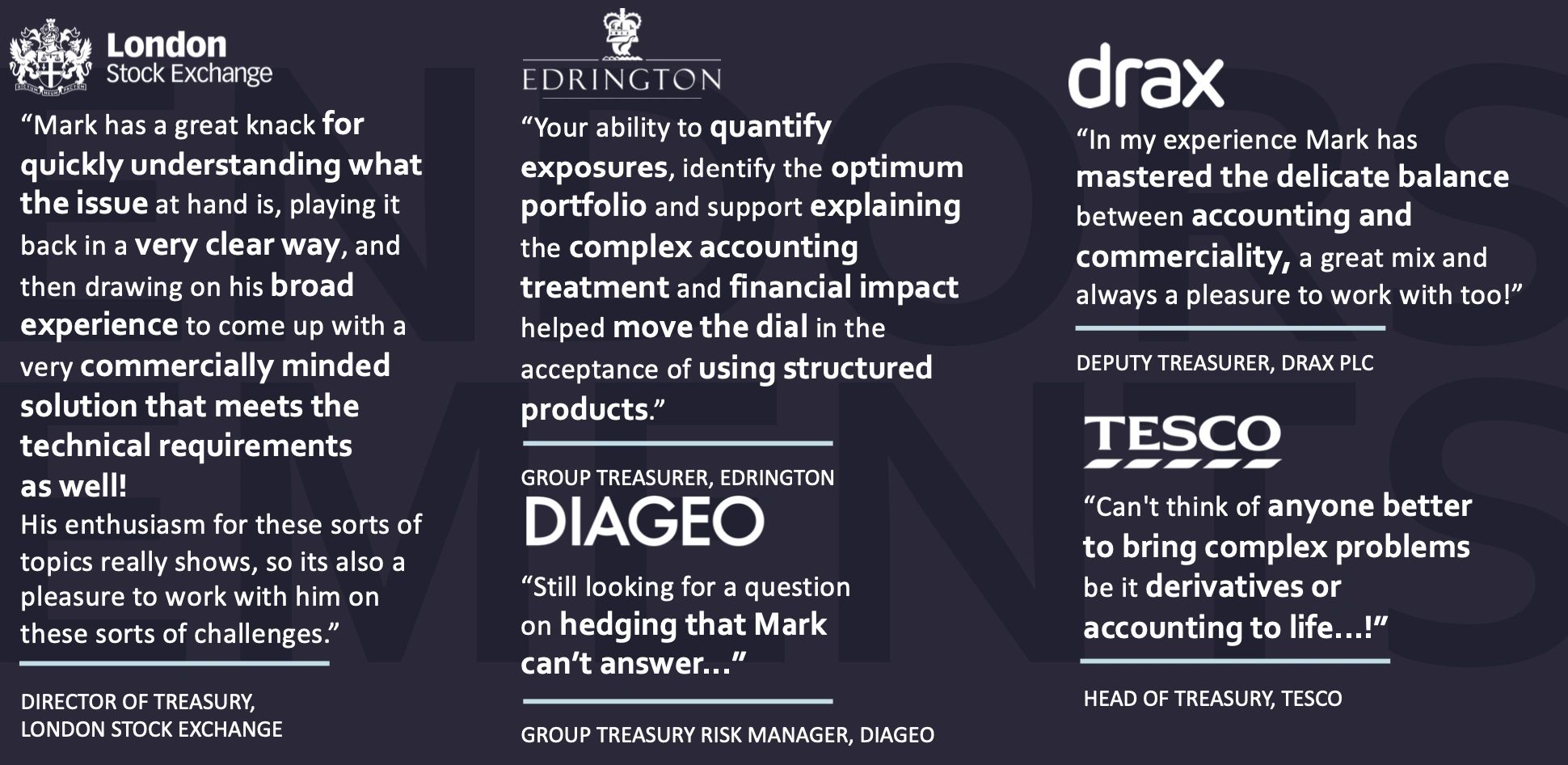

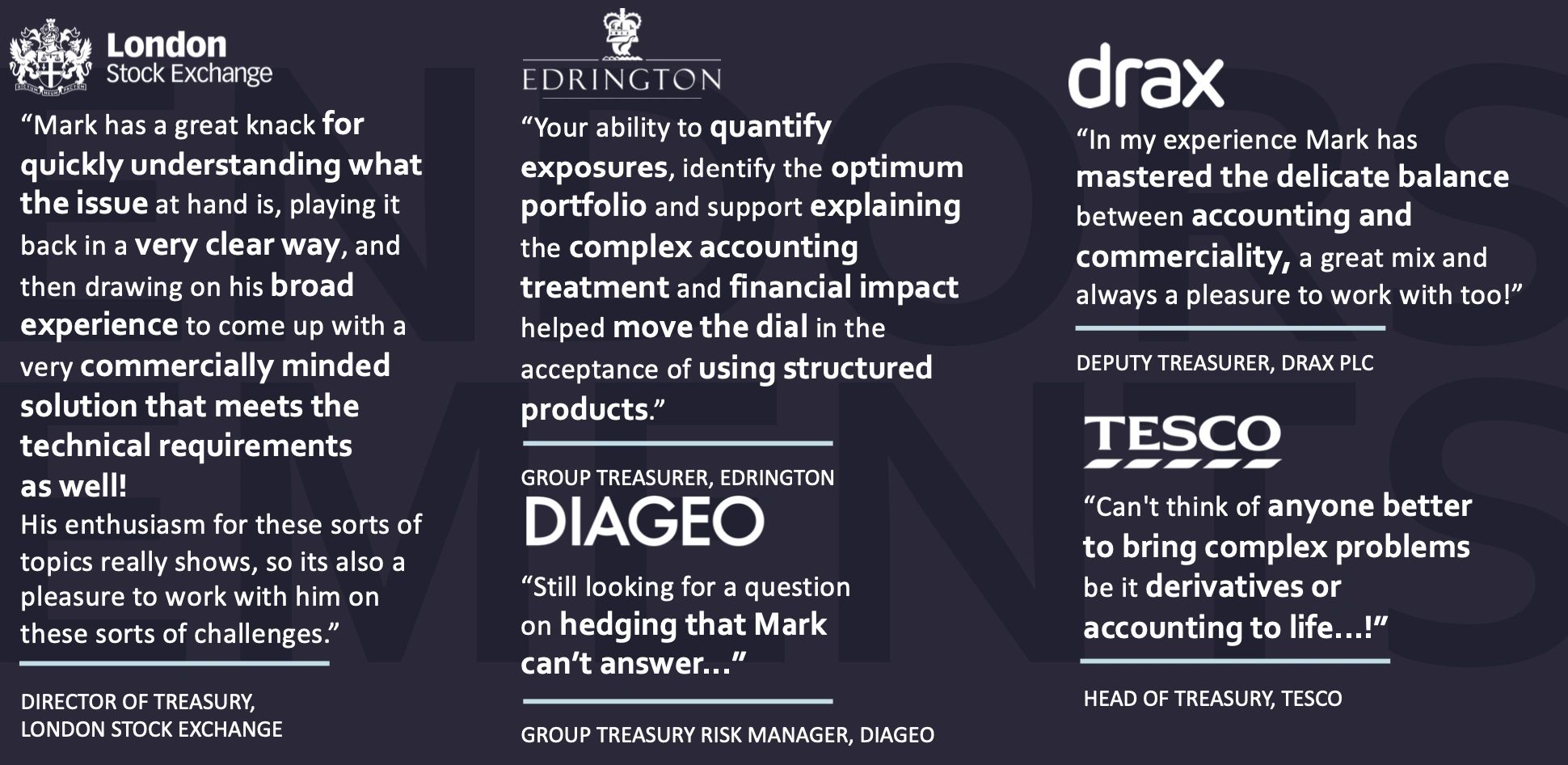

In 2012 I moved into Corporate Risk Advisory at RBS (later NatWest Markets), ultimately leading the team advising all forms of non-financial corporates, from SMEs to the largest global companies such as Johnson & Johnson, Diageo and the London Stock Exchange, on all aspects of financial risk management, financing and liquidity strategies.

Through Principles Consult, I continue front to back treasury risk services- exposure capture, risk quantification (e.g. through sophisticated cross-asset, Value at Risk models), reporting, auditor engagement, management reporting, and execution.

Please reach us at mark.ogorman@principlesconsult.com if you cannot find an answer to your question.

Yes. IFRS and UK GAAP reporting standards are 'principles-based' frameworks. This frequently creates room for interpretation and gaps around practical implementation of guidance. An auditor's study of financial reporting guidance is no substitute for years of practical experience around accepted, pragmatic approaches to implementing that guidance.

Yes. From formation of a hedge-accountable strategy (product and execution approach) through to designation, documentation, effectiveness assessment and measurement, and finally to the accounting entries...our experience is second to none.

Principles Consult primarily exists to provide strategic support, however we have worked with customers to establish relationships, systems and means of execution as well as supporting decision-making and execution timing.

The primary goal of a risk strategy is to manage risk to an acceptable tolerance level, at an acceptable price. Not all risks are worth managing and rarely are all risks worth eliminating completely. Unlike your bank counterparty or an executing advisor, we are transaction-agnostic and will therefore only advise managing risks which are outside of your tolerance- having quantified the risk for you. We are here to be part of your team.

We specialise in all aspects of risk management and financial reporting related to financing, investing, foreign exchange and interest rate risk. This includes but is not limited to:

- interest rates and foreign exchange on fixed and floating rate borrowings;

- foreign exchange risk on foreign currency costs, sales and investments;

- re-financing existing debt facilities at an up-coming maturity or liability management exercises

- foreign exchange and interest rate risk around acquisition and disposal events;

- managing interest rate and foreign exchange risk within credit rating and loan covenant metrics e.g. Net Debt/EBITDA

- hedging and financial reporting considerations around leasing, supply chain finance and infrastructure finance including power purchase arrangements

Send me a message, and tell me more about your objectives and needs. I will get back to you soon to schedule a consultation.

Monday - Friday: 9am - 5pm (London time)

Saturday: By appointment

Sunday: Closed

Copyright © 2024 Principles Consult - All Rights Reserved.

Powered by GoDaddy