Principles-led, strategic financial risk and accounting advisory.

Educating. Policy and process formation. Hedging. Derivative accounting

Signed in as:

filler@godaddy.com

Educating. Policy and process formation. Hedging. Derivative accounting

We are here to provide your company with support around all aspects of financing, financial risk management (e.g. hedging using derivatives) and accounting, including hedge accounting. Whether your concern is around building capability in your team, valuing positions, managing a single cash flow hedge transaction, or developing an entire process around the quantification, management and reporting of financial business risks, debt and derivative portfolios, we can help.

To discuss your needs and concerns please contact Mark at:

Mark.Ogorman@principlesconsult.com

+44 797 005 1261

Or using the WhatsApp or Booking functions below

Before formation of a risk management strategy can even begin we must establish a firm understanding of what your financial business risks look like and where you want to get to in managing them.

This will often require a degree of process mapping, process adjustment and perhaps education on risk factors, risk metrics, risk quantification, derivative accounting/valuation and financial or management reporting. Whether your issue is hedging a single floating rate loan, consolidating foreign currency cashflows from multiple business entities , or assessing and managing risks of an event, we can ensure that risk management actions are understood, in line with best practice and will not give rise to undue complexity or cost for your business.

We are passionate about helping both companies and individuals simplify complexity.

Ensuring that your team has a solid understanding of the fundamentals of risk management and reporting will ensure that your strategy is implemented, as intended, long after we leave. Of course, on-going support is available whenever required.

Building capability and process efficiency within your team will develop the individuals, enhance job satisfaction for them and improve the efficacy of your finance and risk management functions. Ultimately this results in better outcomes for your business.

It also better future-proofs your support functions as the business and financial risk complexity grows.

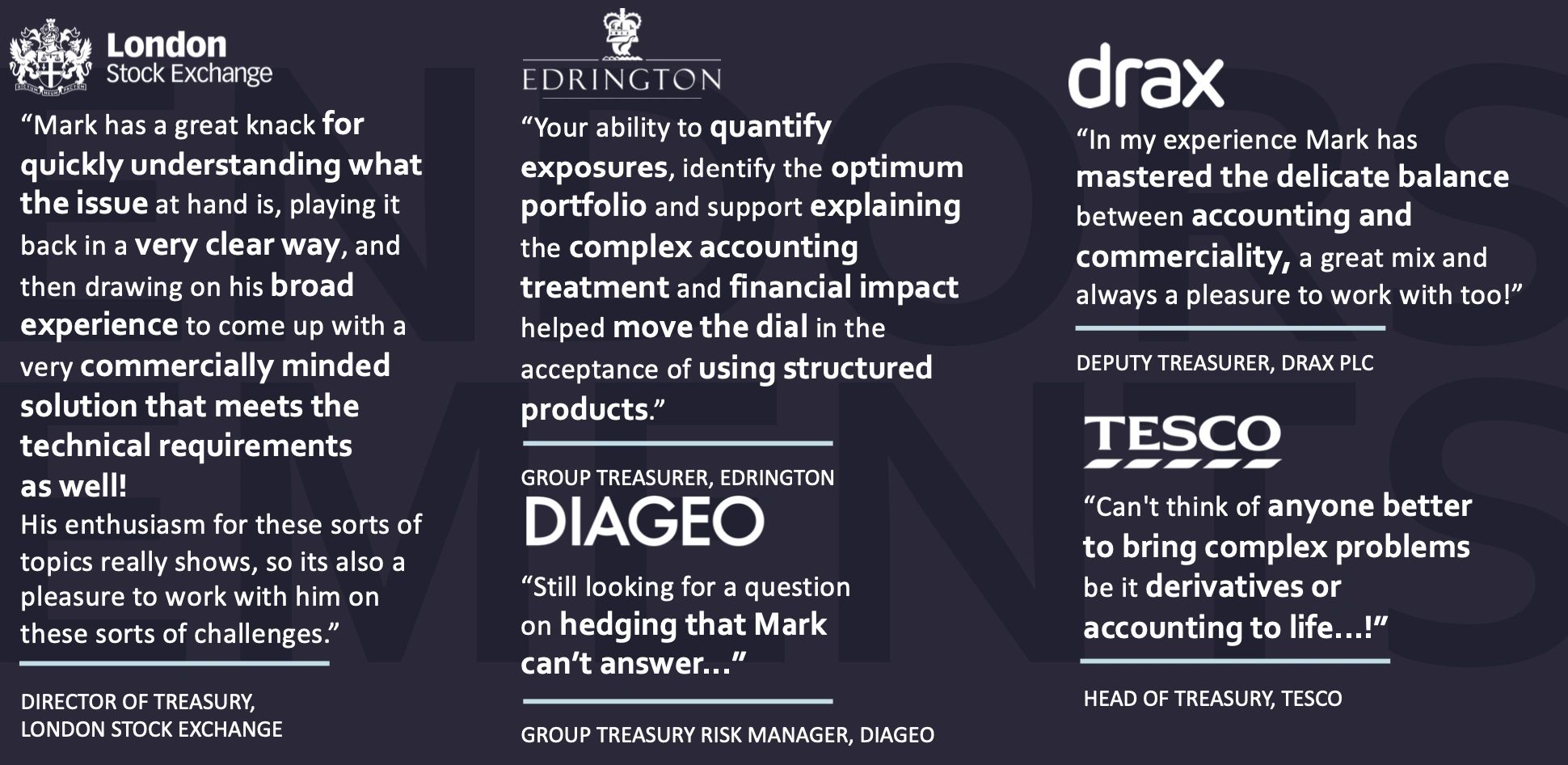

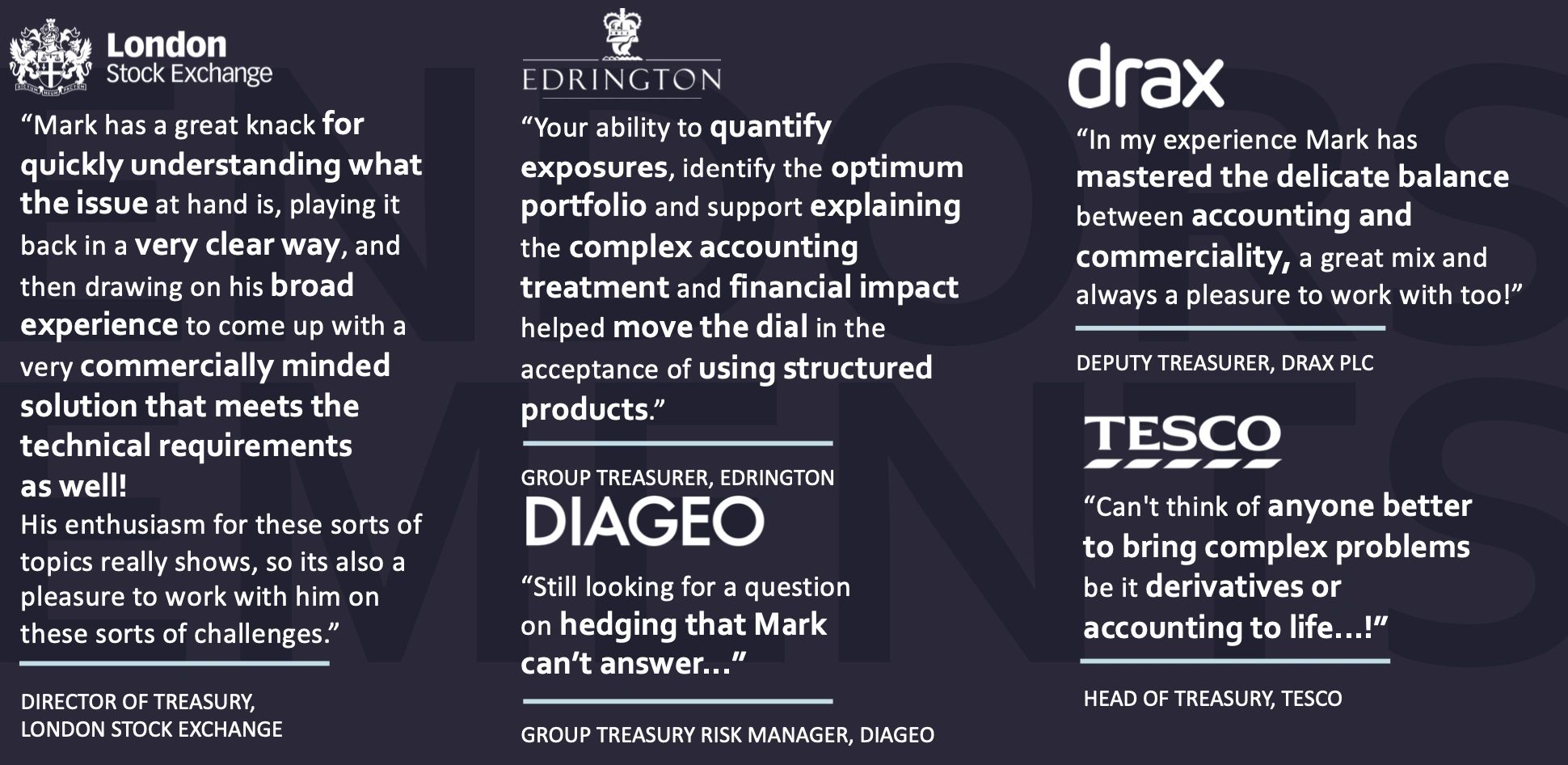

I qualified as an ACA accountant at KPMG in 2001, auditing some of the largest Banks in the world for the first 6 years of my career. I then became a technical transaction accounting specialist across UK GAAP, IFRS and US GAAP at firms including BNP Paribas and Morgan Stanley.

In 2012 I moved into Corporate Risk Advisory at RBS (later NatWest Markets), ultimately leading the team advising all forms of non-financial corporates, from SMEs to the largest global companies such as Johnson & Johnson, Diageo and the London Stock Exchange, on all aspects of financial risk management, financing and liquidity strategies.

Through Principles Consult, I continue front to back treasury risk services- exposure capture, risk quantification (e.g. through sophisticated cross-asset, Value at Risk models), reporting, auditor engagement, management reporting, and execution.

Please reach us at mark.ogorman@principlesconsult.com if you cannot find an answer to your question.

Yes. IFRS and UK GAAP reporting standards are 'principles-based' frameworks. This frequently creates room for interpretation and gaps around practical implementation of guidance. An auditor's study of financial reporting guidance is no substitute for years of practical experience around accepted, pragmatic approaches to implementing that guidance.

Yes. From formation of a hedge-accountable strategy (product and execution approach) through to designation, documentation, effectiveness assessment and measurement, and finally to the accounting entries...our experience is second to none.

Principles Consult primarily exists to provide strategic support, however we have worked with customers to establish relationships, systems and means of execution as well as supporting decision-making and execution timing.

The primary goal of a risk strategy is to manage risk to an acceptable tolerance level, at an acceptable price. Not all risks are worth managing and rarely are all risks worth eliminating completely. Unlike your bank counterparty or an executing advisor, we are transaction-agnostic and will therefore only advise managing risks which are outside of your tolerance- having quantified the risk for you. We are here to be part of your team.

We specialise in all aspects of risk management and financial reporting related to financing, investing, foreign exchange and interest rate risk. This includes but is not limited to:

- interest rates and foreign exchange on fixed and floating rate borrowings;

- foreign exchange risk on foreign currency costs, sales and investments;

- re-financing existing debt facilities at an up-coming maturity or liability management exercises

- foreign exchange and interest rate risk around acquisition and disposal events;

- managing interest rate and foreign exchange risk within credit rating and loan covenant metrics e.g. Net Debt/EBITDA

- hedging and financial reporting considerations around leasing, supply chain finance and infrastructure finance including power purchase arrangements

Send me a message, and tell me more about your objectives and needs. I will get back to you soon to schedule a consultation.

Monday - Friday: 9am - 5pm (London time)

Saturday: By appointment

Sunday: Closed

For a Treasury function, leading your business through a transformational event such as multinational acquisition, disposal or even super-sized capex, can be a minefield. For an acquisition, senior management’s focus will invariably fall on the integration efforts surrounding people, technology and generating the best returns for shareholders through the upcoming restructure- passing regulatory hurdles without giving away too much value, maximising synergies, reducing duplicated effort across all functions and achieving economies of scale.

There will of course be a focus on optimising capital structure and the cost of capital- deciding on the best form of consideration- equity, hybrid equity, public or private market debt, bank facilities or cash reserves.

Whichever route is taken there will be a wealth of timing considerations around issuing, drawing down as well as risk management, tenor considerations and returning the new group to a stable financial profile at least-cost, but with space for flexibility if things invariably don’t go quite to plan.

As with any long journey, planning ahead is critical. Here are five suggestions from PC for dealing with the risk management and funding hurdles:

1) Plan ahead, even if an event is uncertain

As a risk manager you must think and act under business as usual conditions, but plan for those contingent dial-turning events that make you stand out as being worth your salt. Planning for a substantial business change (a positive one, rather than a disaster!) definitely falls in the ‘non-urgent, important’ category of your task list.

In recent times this blogger worked over a period of 2-3years with a FTSE100 entity whose name was always floating in the press with respect to large strategic events. At the time I was called, their name was being associated with a cross-border target that would be a transformational acquisition.

The team ran scenarios on funding, currency mix of funding, interest rate hedging, FX hedging, ratings considerations, debt capacity and the like all on a range of hypothetical scenarios- some linked to the rumours, others not. This would allow the Treasury team to talk in depth with senior management/the Board about risk and capacity considerations and costs, if or when an event happened. It also allowed the team to understand where additional internal approvals or policy changes- the kind of thing that prevents a large organisation from acting both nimbly and efficiently- may be necessary.

And don't just think about how you would react to an event. Think about how you create flexibility in your day to day actions that will open your options in the future. Is there flexibility in treasury policies? Do they provide guidance for big events or just BAU? Are your hedge accounting designations made as flexibly as possible?

2) Its not just an event, life goes on afterwards

It can be easy to focus on the risks around close and the immediate needs associated with it- funding and risk managing the consideration/proceeds. However the go-forward business, whether larger or smaller than before, has risks that persist into the future. That longer time horizon brings a wider spectrum of risk exposure, and this must be planned for before the event.

Both the balance sheet, go-forward P&L and re-financing/de-leverage impacts should be considered so that actions taken around the close do not limit your actions afterward, or increase costs of amending your financing and risk management model further down the line. A classic example here, is the preference of bank syndicate teams to hit ‘sweet spots’ in investors’ demand for tenor which, these days, are longer than you may require to achieve a target de-leveraging plan without incurring additional buy-back costs. In all likelihood the premium incurred for moving away from a sweet spot is likely to be less than the cost of funding too long, or the risk left on the table from funding too short.

3) Plan to pay more when risks are larger

I know- obvious right? But 'high hedging costs' can catch senior stakeholders by surprise.

Besides the fact that events usually involve larger numbers than you encounter in your day-to-day activities, the risks are usually more nuanced too. Regulatory approvals, timing uncertainty and perhaps opacity around risks within a target company all increase the magnitude of risk.

It is a simple rule that if your risks are larger, then the potential benefit of reducing them is larger too and so the cost of managing them would rightly increase.

Deal-contingent trades (ones that fall away with no close-out cost if the exposure you were hedging ceases to exist) and other option-based trades come into their own in this space; but the costs associated with hedging those larger notionals can leave management and Boards a little short of breath.

Again, it may be wise to be ready to give management an early indication of such costs so that they can be built into initial analyses of the viability of a deal, or at least an opportunity to get their head around the cost/benefit analysis.

4) Look for the new natural offsets

Not every new risk requires a new proactive solution. Are you already hedging BAU foreign currency sales which could now be considered a natural hedge of large capex spend? Be ready to go back to your BAU schedule and identify what planned financing and risk management actions can now be amended or ceased because the event introduces exposures which provide a natural offset.

5) Socialise your thought process and plan

As with most complex matters in life- many heads are likely to be better than one. Bring in the key stakeholders and those likely to help you execute on a plan at an early stage. Identify the big risks, the potential roadblocks and the sequencing of events. Think about the time taken to implement, the approvals required (both your own and potential counterparty's processes) and identify whether any commitments to support can be obtained or refreshed periodically.

FINAL THOUGHTS

While the devil is regularly in the detail making sure you are well placed to have time to focus on those details, because the big picture is sketched, is always going to be helpful.

If you need help mapping out a plan for a large event, the risks involved and the best way to quantify and manage those risks, please get in touch via LinkedIn or the principlesconsult.com website.

Join my email list to receive updates and information.

Copyright © 2024 Principles Consult - All Rights Reserved.

Powered by GoDaddy